US Property and Casualty Insurance coverage safety Market Report.

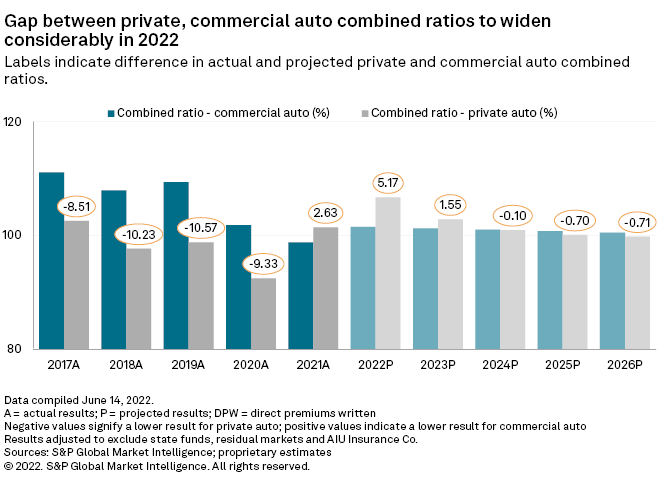

In full yr 2021, the enterprise auto enterprise produced its first sub-100% blended ratio since 2010 in a yr private-passenger auto outcomes shortly deteriorated amid rising inflationary pressures.

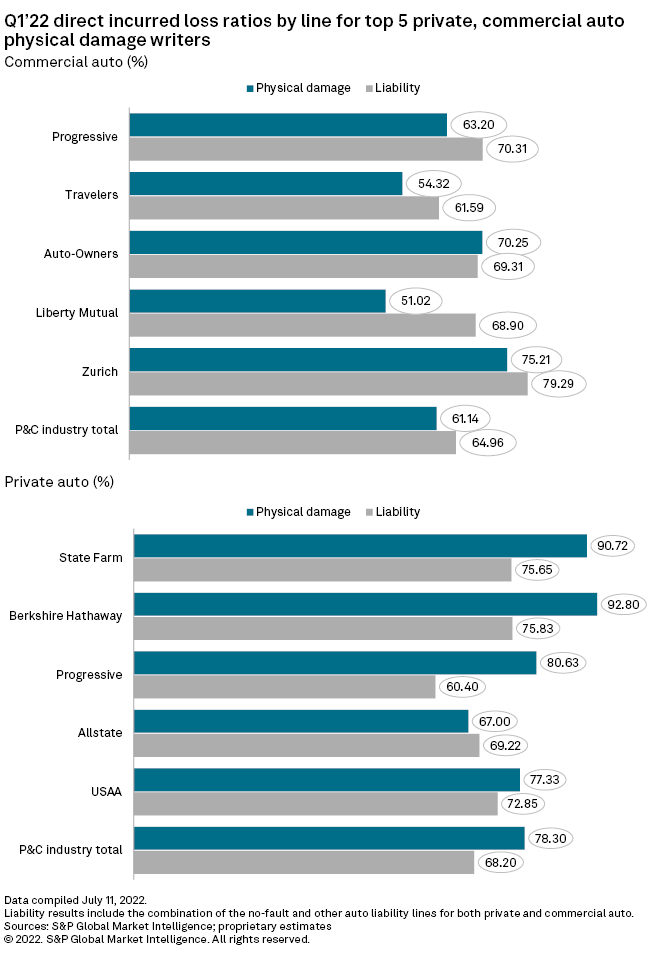

The enterprise line’s outperformance relative to private auto persevered inside the primary quarter of 2022 on account of the enterprise auto direct incurred loss ratio of 64.1%, in response to an evaluation of disclosures in quarterly statutory filings, was 8.3 share elements decrease than that for personal auto, together with a spot of 17.2 share elements contained in the bodily hurt coverages.

Our five-year outlook, as not too means again launched contained in the 2022 U.S. Property & Casualty Insurance coverage Market Report, contemplates blended ratios of 101.5% in enterprise auto and 106.7% in non-public auto in 2022.

Whereas we enterprise convergence in these outcomes all by 2023 and 2024 as non-public auto insurers aggressively pursue worth will enhance to cope with the outcomes of loss-cost inflation, that unfold would rank as the biggest in favor of monetary auto in not decrease than 25 years.

Driving in reverse instructions

The bodily hurt coverages, which embody these which had been most impacted by automotive current chain-driven inflationary pressures, account for a far bigger share of the general non-public auto enterprise than enterprise auto.

Solely 21.0% of full enterprise auto direct premiums written inside the primary quarter rose from the bodily hurt coverages as in distinction with 41.8% in non-public auto.

Bodily hurt coverages have accounted for a slowly shrinking share of full enterprise auto enterprise quantity over the sooner decade whereas they’ve represented an incrementally elevated share of full non-public auto quantity.

An extra divergence could be contained in the offing contained in the close to time interval as non-public auto insurers have been significantly aggressive in directing giant worth will enhance to the collision and full coverages, which could be a part of the bodily hurt line.

Automotive and light-weight truck restore and numerous prices have soared due instantly and by no means instantly to produce chain disruptions, inflicting a rise in widespread collision claims severity.

On the identical time, a spike in catalytic converter thefts and adversarial native climate have contributed to an unlimited deterioration in outcomes for the nice security, one totally different a part of the non-public auto bodily hurt enterprise that’s experiencing important upward worth motion.

It had been the enterprise auto obligation line that produced quite a few of the easiest blended ratios in your full P&C enterprise within the midst of the 2010s, together with ends in further of 113% in 2016 and 2017. As not too means again as 2020, the enterprise auto obligation blended ratio totaled 107.2%.

This compares with a peak non-public auto obligation blended ratio all by the same decade of 109.5% in 2016. And, due largely to an unprecedented decline in driving within the midst of the depths of the pandemic, the non-public auto obligation blended ratio plunged to 94.8% in 2020.

Even in 2021, the enterprise auto obligation blended ratio exceeded 101.4%, and it was the bodily hurt line, the place the enterprise’s blended ratio was solely 90.2%, that led to better-than-breakeven outcomes for the enterprise as a whole.

The 2021 enterprise auto blended ratio of 98.8% all by strains represented an enchancment of three.0 share elements from 2020. It was the enterprise’s greatest consequence since 2010 when a blended ratio of 98.1% capped an eight-year streak of underwriting profitability contained in the enterprise auto enterprise.

A deeper dive into that calendar-year 2021 consequence finds that fallout from accident-year 2020 carried out an unlimited function contained in the enterprise auto obligation enchancment.

The enterprise knowledgeable full adversarial progress of incurred web losses and defense-and-cost-containment funds, or DCCE, of $701.0 million all by all accident years in calendar yr 2021. This marked the underside quantity of unfavorable progress since 2012.

Favorable progress of $425.3 million for accident-year 2020 partially offset adversarial progress of $1.13 billion attributable to all prior accident years.

The group led by Auto-Householders Insurance coverage safety Co. Inc., alone, had $121.3 million in favorable enterprise auto obligation progress for accident-year 2020, in response to its blended annual assertion, with W. R. Berkley Corp., the group led by Federated Mutual Insurance coverage safety Co., and The Vacationers Cos. Inc. exhibiting respective parts of $91.4 million, $49.8 million and $43.6 million.

Carriers have typically remained cautious relating to the enterprise auto obligation enterprise given the potential for social inflation, which regularly is printed on account of the rising frequency of further extreme authorized settlements and jury verdicts, to negatively impact underwriting ends in a strategy akin to the late 2010s.

Headlines about so-called nuclear jury verdicts in opposition to trucking company defendants and considerations relating to the potential for the clearing of a pandemic-induced backlog in courtroom dockets proceed to present the enterprise pause.

Now, even some non-public auto carriers, akin to Interinsurance Commerce of the Car Membership in a mannequin new California worth submitting, have begun to warn relating to the outcomes of social inflation in that enterprise as a contemporary proliferation of further extreme crashes has pushed a spike in motorcar fatalities. That’s vulnerable to drive a larger share of claims with lawyer involvement, which tends to be costlier for insurers.

For the primary quarter of 2022, the enterprise and non-public auto obligation direct incurred loss ratios in distinction unfavorably to the year-earlier interval. Whereas the extent of degradation contained in the non-public auto obligation enterprise exceeded that in enterprise auto obligation, neither of the ratios carried the same type of historic significance on account of the non-public auto bodily hurt consequence.

The 78.3% non-public auto bodily hurt direct incurred loss ratio possibly stands among the many many many enterprise’s worst outcomes on doc, although we’re unable to go looking out out its exact place in a historic context because of a contemporary change in reporting.

The route that the U.S. financial system takes from correct proper right here represents a key variable to our entire P&C business outlook, nonetheless we don’t anticipate {{{that a}}} potential downturn would derail efforts by non-public auto insurers to pursue broad-based worth will enhance.

A recession’s potential impact on top-line enchancment in enterprise auto is normally a definite story as premium writings in that enterprise have traditionally been dependent upon macroeconomic circumstances.

A really highly effective decline in enterprise auto direct premiums written contained in the final 25 years, a retreat of 9.0%, occurred in 2009 when U.S. exact gross residence product enchancment was a dangerous 2.6%.

New disclosures

Nonetheless the scenario unfolds, efforts by the Nationwide Affiliation of Insurance coverage safety Commissioners to advertise consistency contained in the reporting of premiums and losses by line all by annual and quarterly statements will present further granularity into auto obligation and bodily hurt tendencies, amongst completely totally different advantages.

Beforehand, the Underwriting and Funding Exhibit of annual statements and Parts 1 and a pair of of quarterly statements blended enterprise and non-public auto bodily hurt outcomes correct proper right into a single line.

Beginning with the primary quarter of 2022, line-of-business-level disclosures, together with contained in the auto bodily hurt strains, could possibly be the identical all by these schedules together with the state pages and the Insurance coverage safety Expense Exhibit in annual statements.

Equally, the no-fault and completely totally different auto obligation strains could also be damaged out all by all statements after having beforehand been consolidated in some reporting schedules.