Monetary institution of Canada.

Markets can be underestimating how excessive Macklem ought to go, or overestimating Canada’s performance to develop

Creator of the article:

The USA Federal Reserve’s efforts to step up its battle in opposition to inflation will strong doubt on the Financial institution of Canada ’s expertise to restrict its personal cost of curiosity hikes.

At a reputation Wednesday, chairman Jerome Powell signalled Fed officers are poised to extend borrowing prices by bigger than anticipated, and are able to tolerate masses slower progress contained in the course of.

Sign as so much as get maintain of the on daily basis prime tales from the Financial Submit, a division of Postmedia Group Inc.

A welcome e mail is on its methodology. When you do not see it, please research your junk folder.

The subsequent drawback of Financial Submit Prime Tales will quickly be in your inbox.

We encountered a difficulty signing you up. Please strive as quickly as further

It’s an more and more extra foreboding outlook for the U.S. that raises questions on whether or not or not or not Monetary institution of Canada governor Tiff Macklem could have the flexibleness to pull off the tender touchdown that many analysts nonetheless anticipate.

Canada is seen having each quicker progress and cut back prices of curiosity over the next three years — a peculiar mixture of financial outcomes that assumes the nation is extra buffered from worldwide headwinds — together with a doable U.S. recession — however gained’t face the same stress to match the Fed elevated.

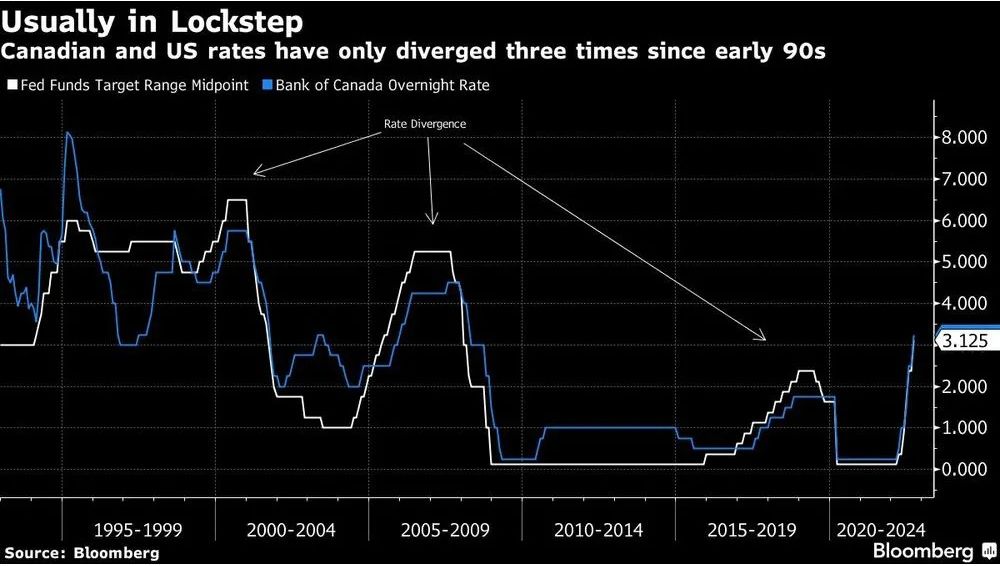

Fast-term cash markets are betting the Monetary institution of Canada will cease its mountaineering cycle at about 4 per cent, versus a Fed benchmark worth seen peaking at about 4.6 per cent, and hold beneath U.S. short-term costs for not less than one completely different three years.

That’s even because of this of the Canadian monetary system is projected to broaden at a quicker tempo than the U.S. According to Bloomberg surveys of economists taken ahead of the Fed choice, progress is predicted to widespread 2.1 per cent in Canada between 2022 and 2024, versus 1.4 per cent contained in the U.S.

“The market has the relative Fed versus Monetary institution of Canada narrative the mistaken strategy up,” Derek Holt, an economist at Monetary institution of Nova Scotia, acknowledged by e mail Thursday.

Historically, when Monetary institution of Canada costs have fallen beneath these on the Fed, it’s usually not coincided with a comparatively stronger Canadian progress image. That counsel markets can be underestimating how excessive Macklem ought to go, or overestimating Canada’s performance to develop.

To make certain, elevated commodity costs are giving Canadian incomes a stronger tailwind, which helps clarify the enlargement outperformance however not why prices of curiosity must be decrease in Canada. New authorities spending aimed in the direction of serving to Canadians deal with the upper worth of dwelling is along with to inflationary pressures. Higher U.S. costs, inside the meantime, are placing downward stress on the Canadian buck and stoking import costs further.

“Why would a commodity producer that retains spending its riches on here-today-gone-tomorrow consumption in serial trend be seen as going by way of so much a lot much less worth hazard than an internet commodity importer going into safety gridlock for the next couple of years,” Holt acknowledged.

One potential rationalization is that underlying value pressures contained in the U.S. are working deeper, maybe ensuing from a tighter labour market. In distinction to its neighbour, Canada is ramping up immigration, which ought to in thought a minimal of assist ease stress off wages and doubtlessly give it extra scope for non-inflationary progress.

Inflation info for August in each nations present some help for this idea, displaying weakening value pressures in Canada however escalating inflationary forces contained in the U.S.

The Monetary institution of Canada is also extra reluctant to jack up borrowing prices given elevated family debt ranges contained in the nation, although that argument suggests underlying financial weak spot pretty than the outperformance many analysts anticipate.

Nonetheless historic earlier reveals that whereas Canada can usually take a specific safety stance than contained in the U.S, there are limits to this divergence — partially as a result of of Canada’s monetary system is so intently linked to its southern neighbour.

Few economists are able to drawback any important divergence of inflation between the 2 nations over the next couple of years. Immigration, inside the meantime, creates its personal inflationary factors contained in the short-term, considerably in housing. And Canada’s weak productiveness numbers give economists little confidence that potential progress will far exceed that contained in the US.

To this level, the Monetary institution of Canada has moved in lockstep with the Fed by means of the primary half of this 12 months. Its in a single day worth is even barely elevated — at 3.25 per cent, versus the three.13 per cent midpoint for the U.S. central financial institution’s goal fluctuate.

Whereas Canadian safety costs have traditionally exceeded the Fed’s on widespread, it’s widespread for short-term borrowing prices contained in the U.S. to diverge elevated for a spell of time.

There have been 4 conditions on condition that mid Nineteen Nineties that U.S. costs have outstripped Canadian costs over a multi-year interval — usually coinciding with conditions of world financial stress. In all however one case (1999-2000), the Canadian monetary system was every barely underperforming or at greatest equaling U.S. progress.